Market Outlook

Investment Opportunity:

A Strategic Approach to Real Estate Financing

Bravo Fund offers investors the unique advantage of being an early adopter in the shifting landscape of the real estate market. As borrower profiles evolve and traditional lenders stick to restrictive guidelines, there’s a growing funding gap that the Bravo Fund is positioned to fill with bespoke financing solutions.

Historical Context: The Aftermath of the Great Financial Crisis

The Great Financial Crisis (GFC) led to the downfall of many mortgage originators and pushed multi-strategy lenders like banks out of mortgage lending. This created a significant funding gap in the market. Stricter regulations and increased scrutiny on traditional banks further limited their ability to lend, creating more opportunities for private lending and funds like Bravo Fund to step in and meet demand.

A Growing Pool of Non-Traditional Borrowers

Since the GFC, the percentage of mortgages backed by government-sponsored entities (GSEs) has risen from 39% to over 65%, pushing lenders to adhere to stringent GSE lending standards. These standards have excluded many non-traditional borrowers who may still be creditworthy but don’t meet the rigid criteria set by traditional lenders. This growing group of borrowers is fueling the rise of the private lending market, where the Bravo Fund is actively capturing opportunities.

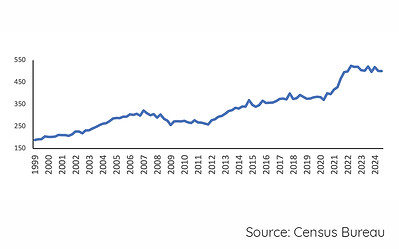

Housing Demand & Supply Gap

There’s a significant housing shortage, with an estimated deficit of nearly 4 million units. The average home age is approaching 40 years, which further drives the demand for property rehabilitation. These combined factors create a strong foundation for home price appreciation, making real estate investments increasingly attractive, ensuring a steady flow of borrowers for the Bravo Fund.

Navigating the Interest Rate Environment

Given the historical interest rate volatility and uncertainty about future rate movements, the short-term nature of our loans makes them less sensitive to interest rate fluctuations. As capital is recycled quickly, our strategy serves as a natural hedge against rising or falling rates. Currently, with rates trending steady-to-declining, the environment is favorable for the Bravo Fund’s investment approach.